New Deadline for Corporate Tax Registration in the UAE

What are the New Deadlines for Corporate Tax Registration in the UAE? As of 8 March 2024 by AccountAbility Team The Federal Tax Authority (FTA)

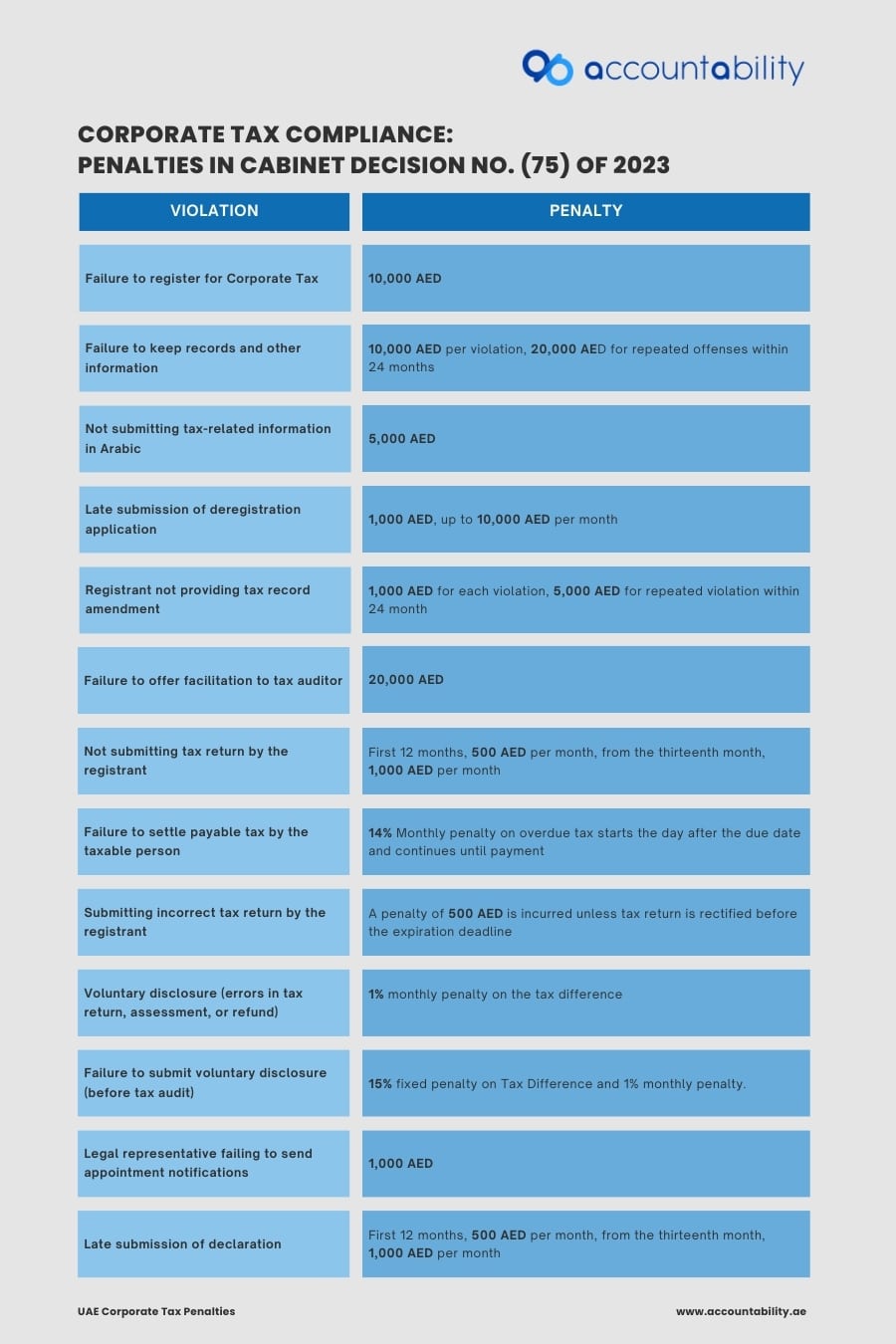

In the United Arab Emirates (UAE), it is important to adhere to Corporate Tax Laws as it is not just advisable but MANDATORY. A crucial step for businesses to avoid hefty fines and penalties imposed by the Federal Tax Authority is to register for Corporate Tax. This is effective from August 1, 2023: failure to comply with these regulations can result in significant financial repercussions. To ensure that your books are in order and that you are complying with the authorities, it is better to seek expert advice to understand the penalties and the way to navigate compliance measures to protect your financial well-being.

Stay Informed: Keep abreast of the latest updates and changes in corporate tax laws in the UAE to avoid penalties and fines that can lead to operational delays and add on to business expenses.

Maintain Accurate Records: Ensure that all financial records, transactions, and documents are accurately maintained and up-to-date. This includes records of income, expenses, assets, liabilities, and tax-related information.

Timely Filing: Submit tax returns and related documents within the specified deadlines. Late filing can lead to penalties, so it’s crucial to adhere to the prescribed timelines.

Pay Taxes Promptly: Make timely payments of corporate taxes based on the prescribed schedule. Delayed payments can lead to fines so it’s important to fulfill tax obligations promptly.

Engage Professional Assistance: Consider hiring tax advisors or consultants with expertise in UAE tax laws. They can provide guidance on compliance requirements, help with tax planning, and ensure accurate filing of tax returns.

Conduct Internal Audits: If required, conduct regular audits of financial records and tax filings to identify any discrepancies or potential issues. Addressing these proactively can help mitigate the risk of fines and penalties.

Respond to Notices Promptly: If the tax authorities issue any notices or inquiries regarding tax compliance, respond to them promptly and provide the required information/documentation. Failure to respond can escalate into penalties.

Seek Voluntary Disclosure: If any errors or omissions are identified in previous tax filings, consider making a voluntary disclosure to the tax authorities. This demonstrates good faith and may result in reduced penalties or leniency.

Compliance Training: Provide training to the necessary personnel involved in financial and tax matters to ensure they understand their responsibilities regarding tax compliance. This can help prevent inadvertent errors or non-compliance.

Review Tax Incentives and Exemptions: Explore available tax incentives, exemptions, and reliefs for which your company may be eligible under UAE tax laws. Utilizing these incentives can help minimize tax liabilities and mitigate the risk of penalties.

You can count on AccountAbility to guide you through the process, ensuring compliance with all UAE Corporate Tax laws. Don’t let fines hinder your financial success! Keep proper records and submit the required documents on time to stay on track with your financial obligations.

Contact us today for a FREE CONSULTATION and explore how our services can benefit your business.

What are the New Deadlines for Corporate Tax Registration in the UAE? As of 8 March 2024 by AccountAbility Team The Federal Tax Authority (FTA)

What Penalties and Fines are Imposed for Failure to Comply with Corporate Tax Regulations in the UAE? As of 01 March 2024 by AccountAbility Team

Who is Exempt from Corporate Tax in the UAE? As of 14 February 2024 by AccountAbility Team Exempt persons, as defined by Federal Decree No.47

Office 205, 2nd Floor, Bay Square,

Building 11, Business Bay,

Dubai, United Arab Emirates