New Deadline for Corporate Tax Registration in the UAE

What are the New Deadlines for Corporate Tax Registration in the UAE? As of 8 March 2024 by AccountAbility Team The Federal Tax Authority (FTA)

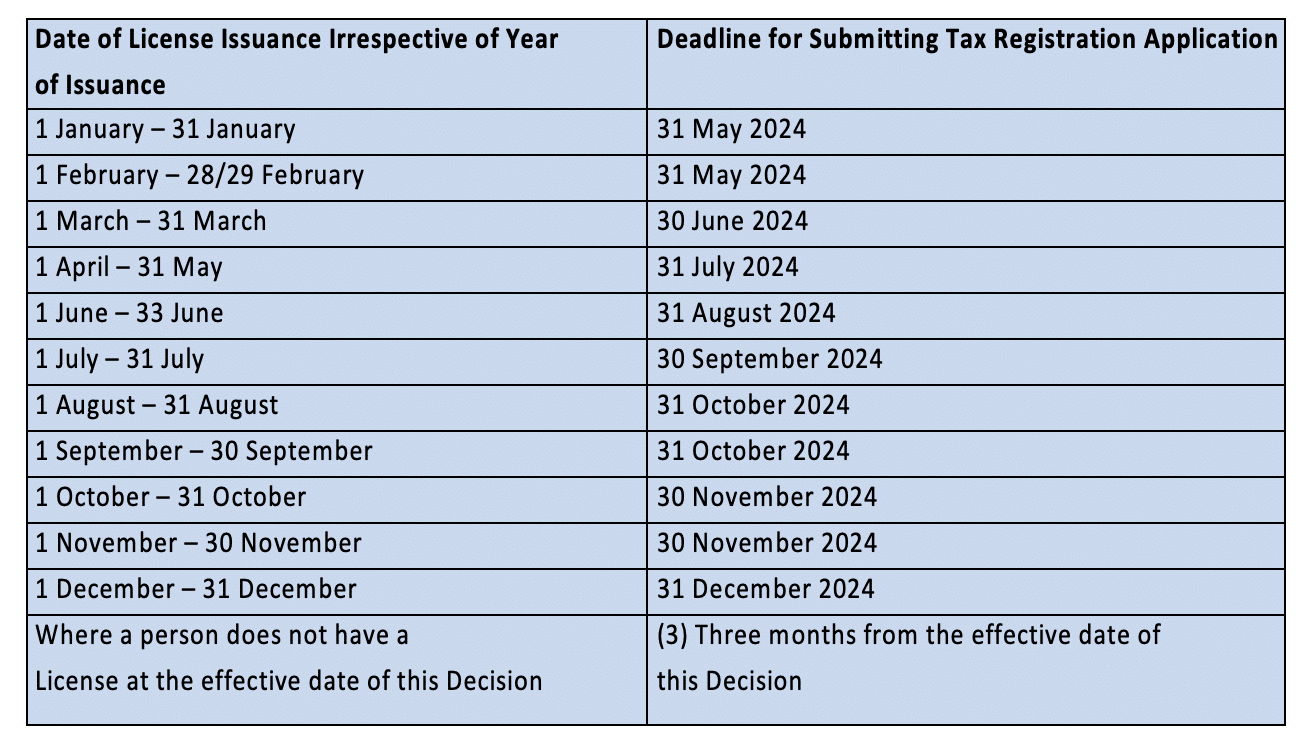

The Federal Tax Authority (FTA) has recently introduced new deadlines for businesses and individuals to register for Corporate Tax in the UAE. These deadlines, detailed in the latest FTA Decree-Law No.47 of 2022, are applicable to entities and individuals subject to Corporate Tax regulations.

Juridical person with more than one License – the license with the earliest issuance date shall be used.

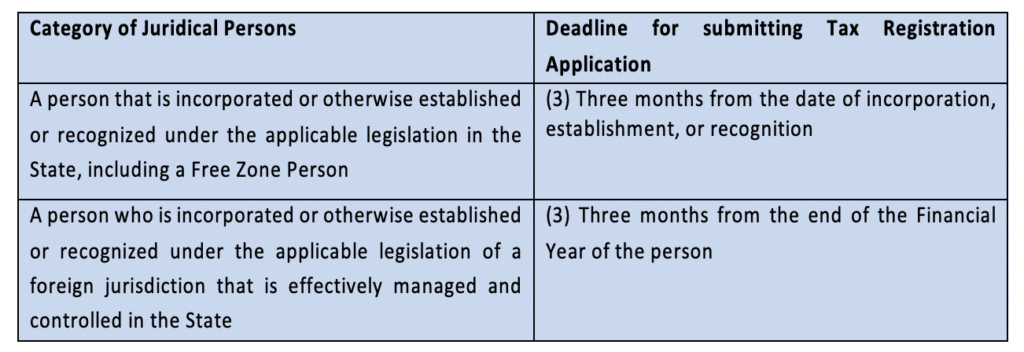

A juridical person that is a Resident Person incorporated or otherwise established or recognized on or after the effective date of this Decision, shall submit a Tax Registration application, in accordance with the following table:

At Accountability, we help businesses with the new UAE tax registration deadlines. We guide you on when to apply based on your company type and when your license was issued. We assist with paperwork, submit applications to the tax authority, and check for compliance. With us, you can avoid fines and get ongoing help with taxes. Please reach out to us at +971 50 623 5061 or info@accountability.ae. Let us make tax registration easier for you.

Contact us today for a FREE CONSULTATION and explore how our services can benefit your business.

What are the New Deadlines for Corporate Tax Registration in the UAE? As of 8 March 2024 by AccountAbility Team The Federal Tax Authority (FTA)

What Penalties and Fines are Imposed for Failure to Comply with Corporate Tax Regulations in the UAE? As of 01 March 2024 by AccountAbility Team

Who is Exempt from Corporate Tax in the UAE? As of 14 February 2024 by AccountAbility Team Exempt persons, as defined by Federal Decree No.47

Office 205, 2nd Floor, Bay Square,

Building 11, Business Bay,

Dubai, United Arab Emirates